Completed

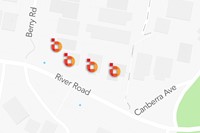

St Leonards, NSW

Residential Properties

Please note that this investment is now closed. The information below is for historical purposes only.

Investment Details

-

Target Return

7.55% net -

Actual Return

7.55% -

Loan to Value Ratio

65% -

Date Commenced

19/10/2018 -

Repaid

18/12/2019 -

Original Term

14 Months -

Actual Term

14 Months